Remember the commodity super-cycle a few years ago?

Prices for things like oil, gold, and copper took off in a big way.

- Crude oil went from $30 in 2005 to $147 in 2008.

- Copper went from $1,600 a tonne in 1999 to $9,000 in 2006.

- Gold went from $252 per ounce to over $1,900 in 2011.

- Aluminum jumped from $0.45 in 1998 to $1.50 in 2006.

- Silver was at $4 in 1992 and climbed all the way to $49.80 in 2011 — a 1,195% gain!

- Even goofy commodities like recycled paper went from $15 in 1999 to $235 in 2008.

- Sulfuric acid was selling for $60 in 2002 and $329 in 2008.

Many people got rich. Millionaires were minted daily — and more than a few millionaires became billionaires…

The New Commodity Super-Cycle

The last bull market in commodities was pushed by China’s rapid growth in manufacturing coupled with cheap money and rabid speculation by Wall Street hot shots.

Demand increased year after year, while supply was tight in the aftermath of a prolonged bear market.

That’s how it works…

At the top, companies over-expand and leverage up, taking on massive debt they will never pay back.

At the bottom, when prices have dropped, these weak companies are destroyed. Mines and wells are shut down. Hedge funds close and no one wants to talk about the stocks.

This is where we are now. Over the past few years, gold conferences that once had 50,000 visitors now have 500.

But things are changing. There is a stealth bull market in commodities…

The Metal Equity Total Return Index has doubled since 2016.

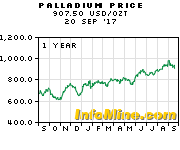

Palladium prices are up:

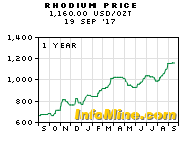

So are rhodium prices — readers of Bubble and Bust Report are up 45% on rhodium.

Zinc is moving higher:

But the big movers are in areas you might not expect. These metals have to do with the alternative energy market — that is, they are used in batteries, wind turbines, and solar power…

Metals like lithium, cobalt, and manganese are in high demand and heading for a supply crunch, all moving higher…

Demand is surging. There are now 10 Gigafactories in the works to produce batteries for electric cars. Elon Musk might have to add four more, and Volkswagen says it will eventually need 40!

Overall, Bloomberg reports that global battery-making capacity is set to more than double by 2021, topping 278 gigawatt-hours a year compared to 103 gigawatt-hours at present. Batteries need these specialty metals.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Wind Turbines Are Booming

Wind turbines just had their best year ever.

According to the American Wind Energy Association, “Every two and a half hours, workers installed a new wind turbine in the United States during the first quarter of 2017, marking the strongest start for the wind industry in eight years.”

“We switched on more megawatts in the first quarter than in the first three quarters of last year combined,” Tom Kiernan, CEO of AWEA, said in a statement.

Nationwide, wind provided 5.6% of all electricity produced in 2016, an amount of electricity generation that has more than doubled since 2010. Much of the demand for new wind energy generation in recent years has come from Fortune 500 companies including Home Depot, GM, Wal-Mart, and Microsoft that are buying wind energy in large part for its low, stable cost.

Fools and Money

Many people would tell you the way to play this boom in alt-energy is to buy Tesla, the electric car company, or GE, a major producer of wind turbines. But these people are idiots.

The way to play the alt-energy boom is to buy the miners. They are severely undervalued, they have what the EV carmakers desperately need, and they will see their margins, incomes, revenue, and stock prices soar.

My buddy Keith Kohl has an excellent play on cobalt that you should be invested in if you aren’t already. You can find it here.

Meanwhile, I’m putting together a portfolio of alt-energy picks that I call the commodity super-cycle 2.0. Be sure to check back every Monday because I will be covering this at length going forward.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.